The Burden Of A Student

Written on Oct 2nd, 2011

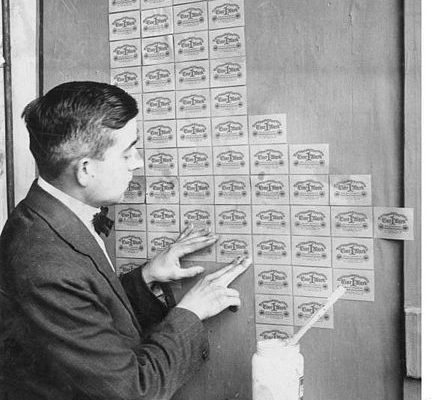

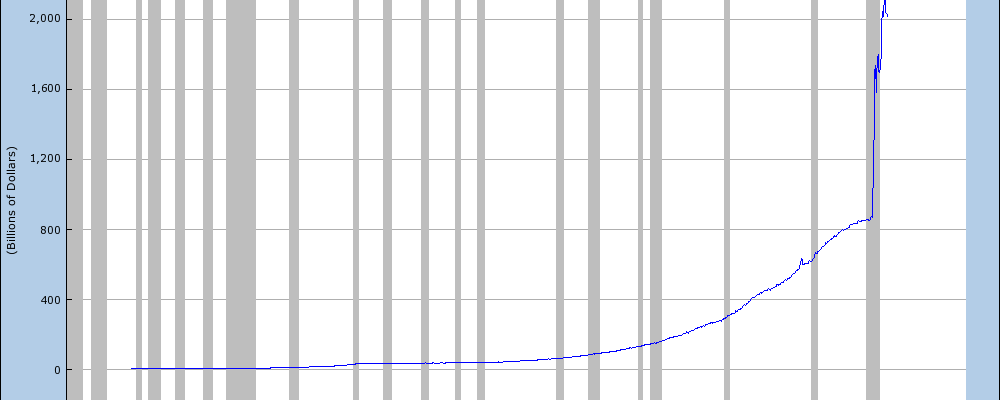

While many people advocate going to school and getting an education, the reality is that education costs are more expensive than most people realize. Canada thankfully provides reasonably priced educations compared to the rest of the world, but it is far from free. Given that I grew up in Chilliwack, and that I had to move out to Vancouver to attend UBC, I spent approximately $11,000 per 8-month period, which included housing on the UBC campus along with a university food program (which tasted fairly similar to prison food, I imagine). Of those costs, approximately $3,000 went towards tuition, $1,000 for books, and the rest towards accommodation, clothes and food. Given that the average engineering summer job back then paid around $2,000 per month, it was essentially impossible to pay for a full year of school by financing it with the money you made during the summers, at least in […]