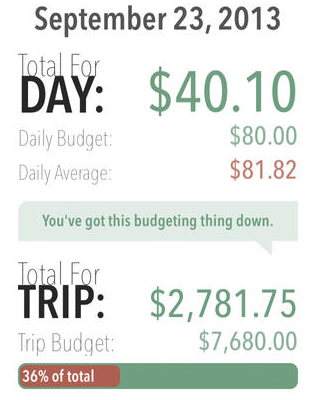

Setting A Budget While You Travel

Written on Jan 3rd, 2014

There are a few privileged travelers that you encounter from time to time who don’t really seem to have any sort of budget. Often they have saved for several years and intend to continue traveling until it simply runs out. But for the rest of us, traveling for more than a week or two often means that we have to stick to a pre-defined budget for a particular trip. I know personally that spending money is the one main aspect of traveling that causes me stress, more so than worrying about theft or how to get to and from places. That’s why I try to set aside a certain amount of money beforehand for each trip, to minimize the anxiety and stress on a day-to-day basis when constantly bombarded with things that cost money. Without a budget you’re likely to spend a crazy amount of money, often for things that […]